Success is being at the right place at the right time?

Place (Product, Price, Place, Promotion) is the third most important component of your “marketing mix”. Obviously, this is where you sell your product but less obvious is the impact good and bad decisions can have on your success. You may be thinking to yourself – I want to sell my product everywhere as fast as possible to maximize sales (Spray & Pray). Unfortunately, where you sell your product can do the exact opposite. This is particularly true for new and emerging brands seeking to establish a beachhead in a market from which to expand distribution. At launch, geography, class of trade and type of retail account can have a significant impact on how rapidly you build distribution and profits. Place can be the difference between new product success and failure.

When a CPG product leaves the manufacturer’s warehouse it enters the distribution channel. Ownership of that product may or may not change hands one or more times before arriving at the place where consumers’ exchange money for product (aka retail). The success of a brand and its products depends on how efficiently and effectively product flows through the distribution channel and into the consumer’s place of consumption (home, office, school, restaurant etc…). Pitfalls include paying too much for distribution, selling in stores with the wrong target market, being in store but not being available, visible, or accessible for purchase.

The distribution channel is in a constant state of flux in North America. We see consolidation within distribution channels, new distributors and new retailers forming constantly. Occasionally entirely new distribution channels appear from seemingly nowhere. A complete analysis of the dynamic North American distribution channel falls outside of the scope of this introduction, but you learn more about building the optimal distribution program in the Ghost Tree Sales blogs.

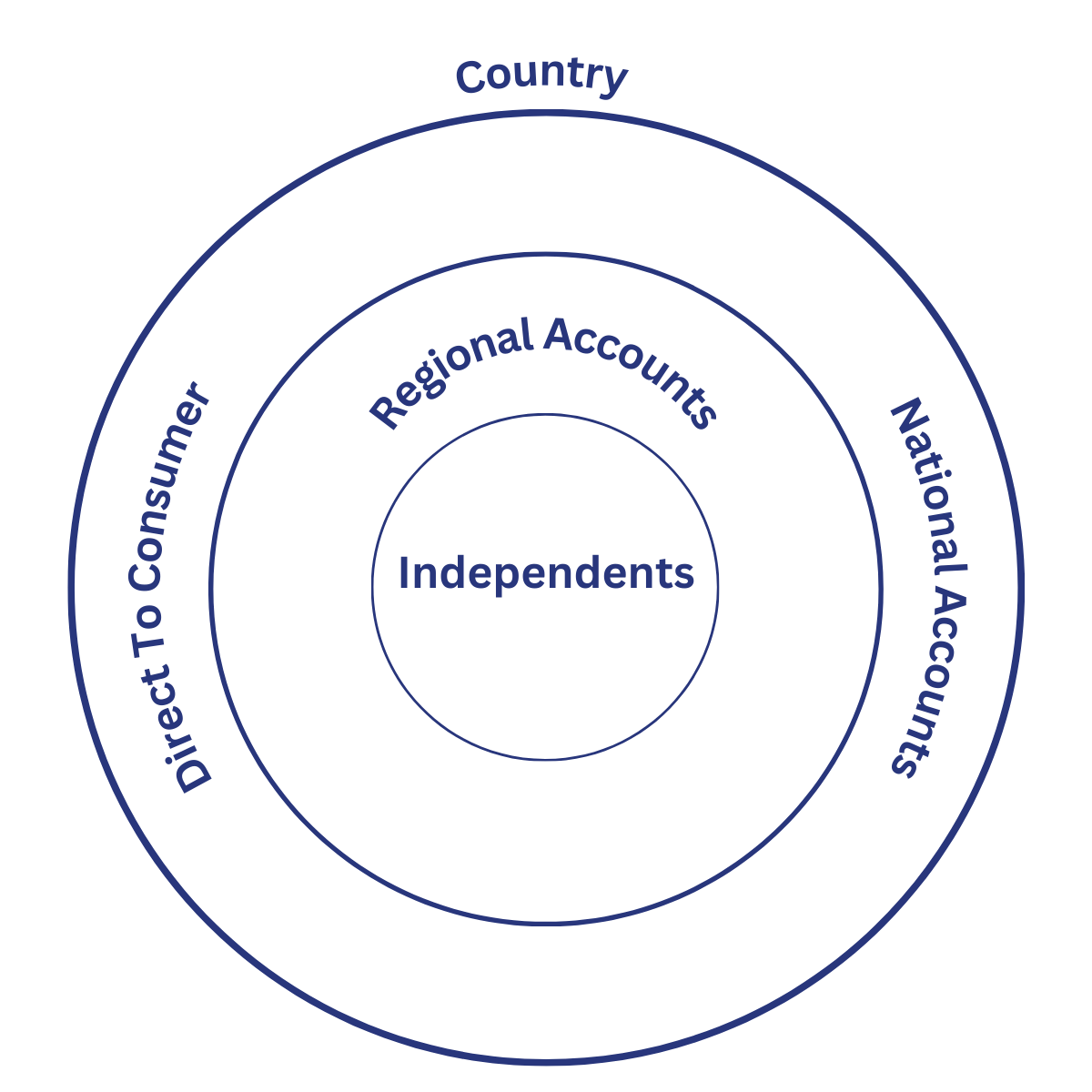

For CPG products, the distribution channel can be segmented in many ways. There is no perfect segmentation model for the North American CPG retail space, but for the purposes of this introduction, we offer the model below for review and debate.

A country has national accounts (chains) & direct-to-consumer retail models that typically cover the entire country. Below these are regional accounts (chains) within a state or covering a number of states (but not all). Then there are independent accounts which are often single store or multiple stores within a tight geographic area.

Below is a list of retail account classifications with examples of accounts within each:

Grocery: Conventional / Specialty / Natural / Cross-over / Discount

Mass: Walmart / Target

Club/Warehouse: Costco / Sam’s Club / BJs

Drug: Rite Aid / Walgreens / CVS

Convenience: Circle K / 7-Eleven

Deep Discount: Marshalls / Ross / Burlington Stores / Grocery Outlet / Big Lots

Big Box: Home Depot / Lowes

Specialty: Michael’s / Best Buy

Foodservice: Restaurants / Hotels

Pure-Play E-Commerce: Amazon / Thrive

Omnichannel E-Commerce: Walmart.com / Target.com

Direct To Consumer E-Commerce (D2C): YourBrand.com

For new and rapidly emerging brands, a carefully laid out distribution plan can make the difference between success and failure. For large established brands the focus is optimizing distribution to capture incremental share and maximize profitability while maintaining a competitive advantage. Below is a quick overview of strategies for new and emerging brands. You will find additional strategies in the Ghost Tree Sales blog along with discussions introducing optimization tactics for established brands.

12 Distribution Principles for New & Emerging Brands:

1. Little Ones: For new CPG businesses it makes sense to start selling direct to local small independent retailers to avoid getting ahead of yourself. Two things. First, small little independents offer a much more forgiving environment to launch new products for a variety of reasons we cover in a separate Ghost Tree Sales blog. If you fail, you can sustain the costs. Second, while they look sexy on paper, if you place your new product in large chains before your target market is ready you can find yourself failing at scale beyond what your business can sustain. If consumers don’t buy at a minimum hurdle rate you will be delisted. Responsible distribution requires patience and prudence…start with the little ones and move your way up the food chain only after you have acceptable consumer awareness, trial and adoption. This will give you the firepower needed to handle large accounts.

2. Big Ones: There are some brands that find themselves in the retail deep end before they can swim. Know that you will be swimming with sharks. Big accounts list big brands with deep pockets. It is not uncommon for established brands to block junior high potential brands by deploying deep price discounts more frequently. Since category managers are data driven at big ones, large brands can artificially deflate junior brand sales by throwing money at the account for a year and effectively starve junior brands of much needed sales. Category managers just see the numbers and are apt to delist the junior brand without noticing the predator pricing tactics. When new products/brands swim in the shallow end they can grow quickly and safely while in the safety of small retail accounts where big brands don’t swim.

3. Focus Fox: Focus on a tight geographic area where you go deep and build your distribution. Taking a shotgun approach to building distribution by grabbing retail distribution all over the country wherever you can get it is not advisable. Be a focus fox rather than a distribution slut. Sluts sell product everywhere, anywhere and to anyone that pays which causes a host of problems.

4. Your Movements Matter: If you are a focus fox you will drive store count in a tight geographic area. If you are working with a distributor, you will be able to drive product through one distributor warehouse at a rate that will meet the distributor’s minimum case movement requirements. Distributors have minimum movement thresholds which can be six or more cases per week per SKU per warehouse. Be a focus fox because your movements matter to distributors. Soft sales stink.

5. Leapfrog: If you have done a good job building your distribution and have worked to ensure rapid velocity in each door (store) you can leapfrog over distributors. This means that you can pitch to large regional or national accounts and justify selling product direct to retailers rather than through distributors. This means you claw back the margin distributors take for your own gain and are much more profitable. Retailers will open space in their warehouse for your product and they will then ship from their warehouse to all their stores. If you are good, you can get the retailer to pick product up at your warehouse and have them pay for delivering it to their distribution center. This is the gold standard.

6. Less is More: This principle applies to all distributors. Distributors are certainly the devil you must dance with when selling CPG products to retail. They play a lot of games to maximize profits which mostly come at the expense of manufacturers. Particularly new and emerging manufacturers. Larger distributors like UNFI, Kehe and DPI all have “marketing” programs they often force new brands to use which are expensive and deliver limited return if any. As a rule of thumb, the less “marketing” programs you use for distributors the better. Further, many distributors are now charging “set up” fees which can be in the thousands of dollars per SKU. This is just a money grab like retailers’ slotting/listing fees. Try to avoid or reduce all of these to help defend your profits. None work to drive your sales. This is why we say less is more with distributors.

7. Pressure Release Valve: The Ghost Tree Sales blog goes into a lot more detail about how to work Deep Discount retailers to your advantage. They can be a low-cost way to drive topline sales and brand trial. They can also be a great way to move excess inventory without losing money during the first few years of launch. As you build up store count and velocity it is helpful to have a place to dump product without losing money so you can refresh your inventory. Think Marshalls, Home Goods, Ross, Big Lots and Burlington Stores to name a few.

8. Demo’s for Dummies: Anyone who believes that in-store demo’s are ineffective or a thing of the past is frankly a “demo dummy”. As someone who has built many brands and has personally run hundreds of in-store demo’s, I can tell you they work very well. Let’s start with the math. Even a small store can get hundreds of unique visitors a day while large stores get thousands. By running in-store demo’s you can introduce your new product to hundreds of new customers per demo. If you convert a small percent of samplers to loyal consumers, you can in short order over a few demo days build a base of brand loyalists for the store. The store manager appreciates your support which comes with a host of benefits. Never mind the multiplier effect that occurs when those new consumers introduce your brand to their friends and family. The problem is, most people are lazy. Demo’s involve hard work. Many brand owners try to outsmart the retail fundamentals and do everything to avoid the work of demo’s. You don’t do the work, you don’t get the benefits. Or, if you have got ahead of yourself and have placed the brand at a large chain where instore demo’s can be expensive…you may be working against your brand because consumer awareness is too low to support the store size.

9. AVA: No, we are not referring to the movie here. What we are referring to is a merchandising principle that Bob taught me at Nestle as a brand manager in confectionery. Availability, Visibility and Accessibility. Availability means that a product has arrived in the store and is placed on shelf. Visibility refers to the quality of shelf placement. Is the product merchandised on shelf such that it is visible to the shopping consumer. If it is obstructed from view by a pillar or if it is on the bottom shelf…it may not be visible to the consumer. Accessibility means that the consumer can reach the product easily and buy it. This is a problem for products on the top shelf where shorter consumers can’t reach the product or if it is merchandised behind the checkout counter or in secure glass display case - the consumer can’t get to it to buy it.

10. Channel Hygiene: Like being a Focus Fox, it makes sense to focus your efforts on one or two channels at a time. This is particularly true for channels like mass (Walmart & Target), club (Costco), drug (CVS) and convenience (Circle K & 7-Eleven). These channels tend to not pioneer new brands and they prefer to sell only established fast turning brands. The message here is to focus your efforts on developing one or two channels at a time and be realistic about when you should extend your brand into channels more geared to established brands.

11. 1+2=4: Take the time to understand basic store math. This will make your sales forecasts more realistic and prevent making presentations to stakeholders that are wildly unrealistic. For example, if you sell a product for $3.00 and you build a sales plan to hit $2,000,000 in your first year, it helps to know how many doors/stores (points of distribution) you need. To hit your sales target, you will need to be in 2,314 stores for a full calendar year:

Case Count: 12

Sales $ Per Unit: $3.00

Case Sell: $36.00

Velocity/Store/Month: 2 cases

Dollar Sales / Store (Door) / Month = $72.00

Annual Sales Per Store = $864.00

# Stores Needed: $2,000,000/$864.00 = 2,314

It is highly unlikely any brand can drive one SKU into 2,314 doors in a calendar year, let along the first month or two which would be needed to come somewhat close to the $2MM sales forecast for the first year. This may seem like an extreme example, but at Ghost Tree Sales we have had many brand owners (particularly from overseas) come to us with similar first year sales targets. They build their forecast by assuming they can get into a small percent of all stores in the US which is a massive market. Unfortunately, they don’t understand realistic and real US store math. If you’re reading this and are frustrated and/or angry because you need to accept that you have built an unrealistic plan, we encourage you to contact Ghost Tree Sales.

12. No Means Later: Don’t be afraid to say no to a retail buyer. If you are negotiating a new item listing and the terms are unfavorable to your business, it’s ok to say no. You are protecting your business and the buyer will appreciate you considering her store’s best interest by not listing because you are not able to drive incremental category sales. No means later because you will tell the buyer that you are not ready to properly serve her business and you will come back when your brand is more developed. This is particularly true when it comes to slotting/listing fees.

You will note that we have not mentioned anything above about placing product where your consumers shop. This and other sales opportunities are available in the Ghost Tree Sales blog.